Welcome to Crypto for Everyone

Learn cryptocurrency in a way that is accessible, stress-free, and supportive of all abilities.

Cryptocurrency can seem complicated, especially for beginners. Our mission is to simplify the world of digital currencies and make it accessible for everyone, regardless of prior experience or technical background. Whether you're just starting out or want to deepen your understanding, we're here to guide you every step of the way.

Here at Crypto for Everyone, we believe in the power of knowledge and community. Our resources are designed to cater to different learning styles, ensuring that everyone can find their own path in the crypto world. From easy-to-understand guides and step-by-step tutorials to informative glossaries and accessible tools, we have everything you need to start your journey into the exciting world of blockchain and cryptocurrency.

Join our growing community, learn at your own pace, and become empowered to make informed decisions in the world of digital finance. Let's break down barriers and make cryptocurrency truly for everyone!

Learn Crypto

What is Cryptocurrency?

Learn Crypto

What is Cryptocurrency?

Cryptocurrency is a digital or virtual currency that uses cryptography for secure financial transactions. Unlike traditional currencies issued by governments, cryptocurrencies operate on a decentralized network, typically using blockchain technology.

Key Features of Cryptocurrency:

- Decentralization: Cryptocurrencies are not controlled by a central authority, such as a government or bank. Instead, they rely on blockchain technology, a public ledger that is maintained by a network of computers called nodes.

- Security through Cryptography: Transactions are secured through cryptography, meaning all the information is encrypted. Private keys and public keys are used to ensure that only the intended recipient can access the funds. This makes cryptocurrencies secure from tampering and unauthorized access.

- Peer-to-Peer Transactions: With cryptocurrency, transactions happen directly between users without the need for an intermediary (like a bank). This process is called peer-to-peer (P2P) trading, which allows for lower fees and quicker transactions.

- Global and Accessible: Anyone with an internet connection can participate in the cryptocurrency market, making it globally accessible. Unlike traditional banking, there are no geographic restrictions, making it a great tool for people without access to traditional banking.

- Limited Supply: Many cryptocurrencies, like Bitcoin, have a finite supply, which helps protect against inflation. For instance, Bitcoins total supply is capped at 21 million coins.

- Transparency and Immutability: Every transaction made with cryptocurrency is recorded on the blockchain and can be verified publicly. Once recorded, it cannot be altered, which ensures immutability and trust.

Popular Cryptocurrencies:

- Bitcoin (BTC): The first and most well-known cryptocurrency, often referred to as digital gold. It was created in 2009 by an anonymous person or group known as Satoshi Nakamoto.

- Ethereum (ETH): Introduced in 2015, Ethereum offers more than just a currency; it also provides a platform for creating smart contracts and decentralized applications (DApps).

- Ripple (XRP), Litecoin (LTC), and Cardano (ADA): Other popular cryptocurrencies, each designed to solve different problems in the financial and technological world.

Real-World Use Cases:

- Remittances: Cryptocurrencies can be used to send money across borders instantly, with low fees compared to traditional bank transfers or money transfer services.

- Online Purchases: Many online retailers are now accepting cryptocurrencies as payment, allowing users to buy goods and services directly.

- DeFi (Decentralized Finance): Cryptocurrencies are being used to create financial services like lending, borrowing, and yield farming without traditional banks. This sector is called DeFi, which aims to make financial services more accessible to everyone.

- Store of Value: Many people consider cryptocurrencies like Bitcoin to be a good store of value, similar to gold, particularly in countries with unstable national currencies.

How Do People Acquire Cryptocurrency?

- Buying on Exchanges: You can buy cryptocurrencies through exchanges like Binance, Coinbase, or Kraken using traditional money (like USD or EUR).

- Mining: Mining involves using computer power to solve complex mathematical puzzles to validate and secure transactions on the blockchain. Miners are rewarded with new cryptocurrency for their efforts.

- Earning: Some platforms allow you to earn cryptocurrency by completing certain tasks, like participating in surveys, promoting a project, or as rewards for using certain services.

Risks and Challenges:

- Volatility: Cryptocurrency prices can be highly volatile. Prices can swing dramatically, which means the value of your holdings can rise or fall significantly in a short period.

- Security Risks: If you lose your private key or recovery phrase, you can lose access to your cryptocurrency forever. Additionally, cyberattacks like hacking and phishing are common risks.

- Regulatory Uncertainty: Since cryptocurrencies are relatively new, governments around the world are still deciding how to regulate them. This regulatory uncertainty can impact their use and adoption.

- Scams: There are many scams targeting new cryptocurrency users, such as Ponzi schemes, fake exchanges, and phishing attacks. Always do thorough research before investing.

Pros and Cons of Cryptocurrency:

Pros:

- Privacy and anonymity in transactions.

- Lower transaction fees compared to traditional banking.

- Increased financial inclusion for the unbanked.

- Ability to protect against inflation in countries with volatile national currencies.

Cons:

- Price volatility makes it a risky investment.

- Not widely accepted for day-to-day transactions.

- Concerns about illegal use for activities like money laundering or tax evasion.

- Lack of regulatory oversight may make it difficult for users to resolve issues.

My Experience: When I first started with crypto, it seemed overwhelming, but understanding the basics made a huge difference.

How Blockchain Works

Blockchain is a distributed ledger technology that forms the backbone of most cryptocurrencies. It is essentially a chain of blocks, where each block contains a list of transactions. These blocks are linked together using cryptographic hashes, making the blockchain secure and tamper-resistant.

Key Features of Blockchain:

- Decentralization: Blockchains operate on a decentralized network of nodes, which means that no single entity has control over the entire network. This feature makes blockchain resistant to censorship and centralized control.

- Transparency: All transactions on a blockchain are recorded in a public ledger that anyone can view. This level of transparency helps ensure trust and accountability.

- Immutability: Once data is recorded on the blockchain, it cannot be altered. This immutability is achieved through cryptographic hashing and consensus mechanisms, ensuring data integrity.

- Security: Blockchain uses cryptographic techniques to secure transactions and data. Each block is linked to the previous one using a cryptographic hash, making it extremely difficult to modify any information without altering the entire chain.

- Consensus Mechanisms: Blockchain networks use consensus algorithms, such as Proof of Work (PoW) or Proof of Stake (PoS), to validate transactions and ensure that all participants agree on the current state of the ledger.

How Does Blockchain Work?

- Blocks and Transactions: Each block on a blockchain contains a list of transactions, a timestamp, and a reference to the previous block. This creates a chain of blocks that records all transactions in a secure and chronological order.

- Hashing: Each block contains a unique hash that is generated based on its data. Any change to the block's data would change its hash, making it easy to detect tampering.

- Distributed Ledger: The blockchain is stored on multiple nodes (computers) across the network. Each node has a copy of the blockchain, and all nodes must agree on the validity of transactions through a consensus mechanism.

Types of Blockchains:

- Public Blockchains: These are open to anyone, and anyone can participate in the network. Bitcoin and Ethereum are examples of public blockchains.

- Private Blockchains: These are restricted networks where only authorized participants can join. Private blockchains are often used by organizations for internal purposes.

- Consortium Blockchains: These are partially decentralized blockchains where a group of organizations manages the network. They are often used for business-to-business transactions.

Real-World Applications of Blockchain:

- Cryptocurrencies: Blockchain is the underlying technology behind cryptocurrencies like Bitcoin and Ethereum, enabling secure and decentralized transactions.

- Supply Chain Management: Blockchain can be used to track the movement of goods through a supply chain, ensuring transparency and reducing fraud.

- Smart Contracts: Smart contracts are self-executing contracts with the terms directly written into code. They run on the blockchain, automatically executing transactions when certain conditions are met.

- Healthcare: Blockchain is used to store and share medical records securely, ensuring data privacy and reducing administrative errors.

- Voting Systems: Blockchain-based voting systems can provide secure, transparent, and tamper-proof elections, reducing the risk of voter fraud.

Pros and Cons of Blockchain:

Pros:

- Highly secure due to cryptographic hashing and decentralization.

- Transparent, allowing anyone to verify transactions.

- Decentralized, reducing the risk of censorship and control by a single entity.

- Immutable, ensuring that records cannot be altered once added to the blockchain.

Cons:

- Scalability issues, as the size of the blockchain can grow significantly over time.

- High energy consumption, particularly for blockchains that use Proof of Work (PoW).

- Complexity, which can make it difficult for non-technical users to understand and implement.

- Regulatory uncertainty, as many governments are still figuring out how to regulate blockchain-based systems.

My Experience: When I learned about blockchain, understanding how it ensures security and transparency really helped me see its potential beyond just cryptocurrencies.

Crypto Security Basics

Crypto security involves protecting your digital assets using private keys, secure wallets, and strong authentication methods. Ensuring the safety of your cryptocurrency is crucial, given the irreversible nature of blockchain transactions.

Key Aspects of Crypto Security:

- Private Keys: A private key is a secret code that allows you to access and manage your cryptocurrency. It is vital to keep your private key confidential and never share it with anyone. Losing your private key means losing access to your funds.

- Wallet Security: Cryptocurrencies are stored in wallets, which can be hot (online) or cold (offline). Cold wallets, like hardware wallets, are considered more secure because they are not connected to the internet and are therefore less susceptible to hacking.

- Two-Factor Authentication (2FA): Enabling 2FA adds an extra layer of security to your crypto accounts. This means that even if someone obtains your password, they would still need a second verification code to access your account.

- Backup and Recovery Phrases: Most wallets provide a recovery phrase, also known as a seed phrase, which can be used to restore your wallet if you lose access. It is crucial to write down your recovery phrase and store it in a safe place.

- Phishing Awareness: Phishing attacks are common in the crypto world. Be cautious of emails or websites that attempt to trick you into providing your private keys or login details. Always verify URLs and avoid clicking on suspicious links.

- Secure Internet Connection: When accessing your crypto accounts, use a secure and private internet connection. Avoid using public Wi-Fi, as it can be vulnerable to attacks that may compromise your information.

Types of Crypto Wallets:

- Hardware Wallets: Physical devices that store your private keys offline, providing the highest level of security. Examples include Ledger Nano X and Trezor.

- Software Wallets: Applications that can be installed on your computer or smartphone. These are convenient but require additional security measures to protect against malware.

- Paper Wallets: A physical piece of paper that contains your private keys. This is a cold storage method but must be kept safe from physical damage or loss.

- Web Wallets: Wallets hosted by a third party, typically an exchange. These are the least secure, as you do not have full control over your private keys.

Common Security Risks:

- Hacking: Hackers often target exchanges and hot wallets. Keeping your funds in a hardware wallet reduces the risk of being a victim of hacking.

- Social Engineering: Scammers may impersonate support staff or trusted figures to gain access to your funds. Always verify identities before sharing any sensitive information.

- Malware: Malicious software can be used to steal your private keys or login credentials. Regularly update your devices and use antivirus software to mitigate this risk.

Best Practices for Crypto Security:

- Use Cold Storage: Store the majority of your cryptocurrency in a hardware wallet or another form of cold storage to keep it safe from online threats.

- Enable 2FA: Always enable two-factor authentication on your exchange and wallet accounts for additional security.

- Be Skeptical: Always be wary of unsolicited messages, emails, or social media posts offering investment opportunities or asking for personal information.

- Regularly Update Software: Keep your wallet software, antivirus, and operating systems up to date to protect against vulnerabilities.

- Separate Devices: Use a separate device for accessing your cryptocurrency accounts to minimize the risk of malware and phishing attacks.

My Experience: Losing access to a wallet taught me the importance of backups and securing my recovery phrases. I now use a hardware wallet and store my recovery phrase in a secure location to ensure my funds are safe.

FAQs for Beginners

- What is the minimum amount I need to start investing in crypto?

Many exchanges allow investments as small as $10. Start small to minimize risk. - Is cryptocurrency legal?

Crypto is legal in many countries, but regulations differ. Research your local laws before investing. - Do I need a lot of technical knowledge?

No! Many platforms are beginner-friendly and include tutorials. Start with small, simple transactions. - What is a wallet, and do I need one?

A crypto wallet is a tool that allows you to store and manage your digital assets. If you plan on buying and holding crypto, a secure wallet is essential. You can choose between hardware, software, and web wallets based on your needs. - How do I keep my crypto safe?

Use a secure wallet, enable two-factor authentication, and never share your private keys. Consider using cold storage for long-term holdings. - Can I lose my money in crypto?

Yes, cryptocurrencies are highly volatile, and you can lose your investment. Only invest what you can afford to lose, and diversify your holdings to manage risk. - How do I buy cryptocurrency?

You can buy cryptocurrencies on exchanges like Binance, Coinbase, or Kraken. You will need to create an account, verify your identity, and link a payment method such as a bank account or credit card. - What is a private key?

A private key is a secret code that allows you to access your cryptocurrency. It is important to keep your private key safe, as anyone with access to it can control your funds. - What is the difference between Bitcoin and other cryptocurrencies?

Bitcoin was the first cryptocurrency and is often referred to as digital gold. Other cryptocurrencies, like Ethereum, have different functionalities, such as enabling smart contracts and decentralized applications (DApps). - What are transaction fees?

Transaction fees are small charges that users pay to miners or validators to process transactions on the blockchain. These fees vary depending on the network's congestion and the type of cryptocurrency.

Scams and Scammers

Crypto scams are increasingly common. Here are common scam types, red flags to watch for, and tools to stay safe:

Common Types of Scams

- Phishing: Fake emails or websites designed to steal your private keys or passwords.

- Ponzi Schemes: Promises of high returns with little or no risk, relying on new investors to pay earlier ones.

- Impersonation: Scammers pretending to be support agents, influencers, or project representatives.

- Fake Wallets: Fraudulent apps that steal private keys.

Red Flags

- Unsolicited investment offers or messages.

- Promises of guaranteed high returns.

- Requests for private keys, passwords, or recovery phrases.

- Websites with poor design or incorrect URLs (e.g., misspelled project names).

Tools to Stay Safe

- VirusTotal: Scan suspicious links and files.

- Have I Been Pwned: Check if your email or passwords have been compromised.

- Etherscan: Verify smart contract addresses and project legitimacy.

- Coinfirm AML Reports: Check for known fraudulent wallets or addresses.

- Blockchain Explorer: Analyze blockchain data to spot irregularities.

Tips to Avoid Scams

- Use official links provided by trusted sources (e.g., project websites).

- Enable two-factor authentication (2FA) on all accounts.

- Store private keys offline in a hardware wallet like Tangem 2/3 card or Ledger Nano X.

- Join official communities (e.g., Discord or Telegram) to verify information.

Important Websites

Here are some essential websites for staying informed, ensuring security, and accessing resources in the world of cryptocurrency:

- VirusTotal: Scan suspicious links and files to protect your devices from malware.

- Have I Been Pwned: Check if your email or passwords have been compromised in a data breach.

- Etherscan: Verify smart contract addresses, check wallet activity, and track Ethereum transactions.

- CoinGecko: Track cryptocurrency prices, market data, and project information.

- Coinfirm AML Reports: Check for known fraudulent wallets or addresses to avoid scams.

- Blockchain Explorer: Analyze blockchain data, verify transactions, and track Bitcoin addresses.

- Trust Wallet: A secure and beginner-friendly mobile wallet to store various cryptocurrencies.

- Ledger Nano X: A hardware wallet that provides top-level security for your digital assets.

- MetaMask: A browser-based wallet for accessing decentralized apps and managing Ethereum-based tokens.

- Kraken: A popular cryptocurrency exchange that offers trading and secure storage.

- Binance: One of the largest cryptocurrency exchanges for trading, buying, and staking crypto assets.

- Coinbase: A beginner-friendly platform for buying and selling cryptocurrencies.

- Trezor: A hardware wallet providing secure offline storage for cryptocurrencies.

- Internet Crime Complaint Center (IC3): Report scams and fraudulent activity related to cryptocurrencies.

- Action Fraud UK: The UK's national reporting center for fraud and cybercrime.

- Financial Conduct Authority (FCA): Information about regulations and warnings on crypto-related scams in the UK.

- CryptoScamDB: A database to check for known crypto scams and stay informed about suspicious projects.

- National Institute of Standards and Technology (NIST): Resources on best practices for cybersecurity, including securing digital assets.

- U.S. Securities and Exchange Commission (SEC): Updates on regulations, investor alerts, and guidance regarding cryptocurrency investments.

- Binance Academy: Educational resources for learning about cryptocurrency, blockchain technology, and how to trade safely.

Emotions

Crypto Glossary

Learn the key terms used in the world of cryptocurrency and blockchain technology.

- Blockchain: A decentralized ledger of all transactions across a network.

- Decentralization: The distribution of power and decision-making away from a central authority.

- Private Key: A secret key that allows you to access and manage your cryptocurrency.

- Wallet: A tool that allows you to store, send, and receive cryptocurrencies.

- Mining: The process of validating transactions and adding them to the blockchain.

- Altcoin: Any cryptocurrency that is not Bitcoin. Examples include Ethereum, Litecoin, and Ripple.

- Exchange: A platform where you can buy, sell, or trade cryptocurrencies.

- Fiat: Traditional government-issued currency, like USD, EUR, or GBP.

- HODL: A term used in the crypto community meaning to hold onto your cryptocurrency rather than selling it, regardless of market conditions.

- Smart Contract: A self-executing contract where the terms of the agreement are directly written into code.

- DeFi (Decentralized Finance): A financial system built on blockchain technology that allows users to lend, borrow, and earn interest without relying on traditional banks.

- Gas Fees: A fee paid to miners to process and confirm transactions on the blockchain, typically associated with Ethereum.

- Token: A digital asset created on a blockchain that can represent a variety of things, from assets to rights.

- Proof of Work (PoW): A consensus mechanism used by some blockchains, like Bitcoin, that requires participants to solve complex mathematical problems to validate transactions.

- Proof of Stake (PoS): A consensus mechanism that allows participants to validate transactions based on the number of tokens they hold and are willing to "stake" as collateral.

- Ledger: A record of financial transactions. In cryptocurrency, it refers to the blockchain.

- Faucet: A website or application that rewards users with small amounts of cryptocurrency in exchange for completing tasks.

- Cold Wallet: An offline wallet used for storing cryptocurrency securely, often in the form of hardware or paper wallets.

- Hot Wallet: An online wallet connected to the internet, suitable for storing smaller amounts of cryptocurrency for daily transactions.

- FOMO: Fear Of Missing Out, a psychological phenomenon where people feel anxious or pressured to take action because they believe they might miss an opportunity that others are benefiting from.

Step-by-Step Guide

Follow these simple steps to get started with cryptocurrency:

- Create a Wallet: Choose a wallet like Trust Wallet, Coinbase or MetaMask to store your crypto. (many more wallets are available)

Download a wallet app from ONLY the official website or app store, and follow the setup instructions to create your wallet. Make sure to write down your recovery phrase and store it in a safe place.

- Buy Cryptocurrency: Use an exchange like Coinbase or Binance to purchase your first cryptocurrency.

Create an account on an exchange, verify your identity, link your payment method, and buy your desired cryptocurrency. Start with small amounts to get comfortable with the process.

- Secure Your Wallet: Enable two-factor authentication and backup your recovery phrase.

Security is crucial in crypto. Always enable two-factor authentication (2FA) and make sure to backup your wallets recovery phrase.

- Learn the Basics: Familiarize yourself with blockchain technology and how transactions work.

Understanding the basics of blockchain will help you make informed decisions. Read beginner guides, watch videos, and explore resources like this sites glossary to understand key concepts.

- Practice Small Transactions: Start by transferring small amounts to understand how fees and transfers work.

Practice transferring a small amount from your exchange to your wallet. This will help you understand network fees and the transaction process.

- Stay Informed: Follow crypto news and updates to keep learning.

Cryptocurrency is constantly evolving. Follow news websites, join crypto communities, and stay updated with the latest trends and updates.

Crypto Tax Guide

Understanding these steps will guide you to stay legal with your cryptocurrency tax:

Cryptocurrency Taxation Worldwide

As the adoption of cryptocurrencies grows globally, understanding the tax implications in different jurisdictions is crucial. Below is an overview of how various countries approach the taxation of cryptocurrencies.

United States

Tax Treatment: The Internal Revenue Service (IRS) classifies cryptocurrencies as property. This means that general tax principles applicable to property transactions apply to transactions using virtual currency.

Capital Gains Tax: Profits from selling or exchanging cryptocurrencies are subject to capital gains tax. Short-term gains (assets held for less than a year) are taxed at ordinary income rates, while long-term gains benefit from reduced rates.

Income Tax: Receiving cryptocurrency as payment for goods or services, mining, staking, or as airdrops is considered ordinary income and taxed accordingly.

Reporting Requirements: Taxpayers must report all crypto transactions. The IRS has intensified its oversight and will have more information on crypto assets starting next year. Experts recommend maintaining accurate digital records to prepare for the enhanced reporting requirements. Source

United Kingdom

Tax Treatment: Her Majesty's Revenue and Customs (HMRC) treats cryptocurrency as property, not currency.

Capital Gains Tax: Individuals are liable to pay capital gains tax when they dispose of their crypto assets if their total gains exceed the annual allowance.

Income Tax: Earning cryptocurrency through mining, staking, or as payment is considered income and subject to income tax.

Reporting Requirements: Taxpayers must report their crypto transactions on their Self Assessment tax return. HMRC has intensified its oversight of crypto transactions, utilizing data from exchanges to ensure compliance. Source

Canada

Tax Treatment: The Canada Revenue Agency (CRA) treats cryptocurrency as a commodity.

Capital Gains Tax: Selling or exchanging cryptocurrency can result in a capital gain or loss, which must be reported.

Income Tax: Income from cryptocurrency mining or as payment for goods and services is considered business income.

Reporting Requirements: Taxpayers are required to keep records of their crypto transactions and report them accurately.

Australia

Tax Treatment: The Australian Taxation Office (ATO) treats cryptocurrency as property for tax purposes.

Capital Gains Tax: Disposing of cryptocurrency may result in a capital gain or loss. Personal use asset exemptions may apply in limited circumstances.

Income Tax: Cryptocurrency received as income, such as through mining or as payment, is taxable as ordinary income.

Reporting Requirements: Individuals must report their crypto transactions and maintain records for tax purposes.

Germany

Tax Treatment: Germany considers cryptocurrency as private money, not legal tender.

Capital Gains Tax: Private sales of cryptocurrency are tax-free if the held period exceeds one year. Otherwise, gains are taxable if they exceed €600 per year.

Income Tax: Mining and other commercial activities involving cryptocurrency are subject to income tax.

Reporting Requirements: Taxpayers must report their crypto-related income and gains in their tax returns.

Japan

Tax Treatment: The National Tax Agency (NTA) classifies cryptocurrency as miscellaneous income.

Income Tax: Profits from selling, trading, or using cryptocurrency are subject to progressive income tax rates, which can be as high as 55%.

Reporting Requirements: Individuals must declare their crypto income in their annual tax filings.

India

Tax Treatment: India has introduced specific taxation for cryptocurrency transactions starting in 2022.

Capital Gains Tax: Cryptocurrency transactions are subject to a flat 30% tax on gains. No deductions for expenses are allowed except for the cost of acquisition.

Withholding Tax: A 1% Tax Deducted at Source (TDS) is applied on all crypto transactions exceeding specific thresholds.

Reporting Requirements: Individuals must report crypto gains and taxes paid in their income tax filings.

France

Tax Treatment: France considers cryptocurrencies as digital assets.

Capital Gains Tax: Individuals are taxed at a flat rate of 30% on capital gains from cryptocurrency transactions.

Income Tax: Earnings from mining or professional trading activities are subject to income tax.

Reporting Requirements: Cryptocurrency holdings and gains must be reported in annual tax filings.

Singapore

Tax Treatment: Singapore does not have a capital gains tax, making it a favorable jurisdiction for cryptocurrency investors.

Income Tax: Cryptocurrency transactions related to business or trading are subject to income tax.

Reporting Requirements: Business-related crypto transactions must be reported for tax purposes.

South Korea

Tax Treatment: South Korea has recently implemented new tax rules for cryptocurrencies.

Capital Gains Tax: Starting in 2023, a 20% tax applies to gains exceeding 2.5 million KRW per year.

Reporting Requirements: Cryptocurrency exchanges are required to report transactions, and individuals must declare gains in their annual tax filings.

Note: The information provided here is for general guidance only. Tax laws vary by country and are subject to change. Always consult with a tax professional or the official tax authority in your jurisdiction for accurate and up-to-date advice.

Accessibility Tools

Explore tools and platforms that make cryptocurrency accessible to users with various disabilities. From wallets to trading apps, these resources are designed to enhance usability and inclusivity.

Exodus Wallet

Exodus Wallet is a beginner-friendly wallet compatible with screen readers, making it accessible for visually impaired users. It supports a wide variety of cryptocurrencies and has an intuitive design with integrated portfolio tracking.

Key Features:

- Screen reader compatibility for visually impaired users.

- Support for over 100 cryptocurrencies.

- Desktop, mobile, and hardware wallet integration.

Trust Wallet

Trust Wallet is an accessible mobile wallet that supports various tokens and NFTs. Its simplified interface and touch-based navigation make it ideal for users with mobility challenges.

Key Features:

- Integration with decentralized apps (DApps).

- Supports Ethereum-based NFTs.

- Touch-friendly interface for mobile users.

Robinhood

Robinhood is a trading platform with a user-friendly interface and accessibility options for individuals with visual impairments. It supports features like high-contrast modes for improved visibility and keyboard navigation for easier trading.

Key Features:

- High-contrast color themes for better visibility.

- Keyboard-friendly navigation for simplified trading.

- Beginner-friendly design with easy-to-follow instructions.

Coinbase

Coinbase is one of the most popular cryptocurrency platforms, offering a highly accessible interface and educational resources. It supports keyboard navigation and screen readers, ensuring usability for everyone.

Key Features:

- Keyboard-friendly interface.

- Extensive crypto learning materials for beginners.

- High accessibility score with screen reader support.

Binance

Binance is a leading exchange with accessibility-focused features such as dark mode for low-vision users and multilingual support. It also provides customizable dashboards to meet diverse user needs.

Key Features:

- Dark mode for users with light sensitivity.

- Supports multiple languages for broader accessibility.

- Customizable interface for personalized trading experiences.

MetaMask

MetaMask is a browser-based wallet that integrates with various decentralized apps (DApps). It supports screen readers, making it accessible for visually impaired users, and offers a simplified interface for easy navigation.

Key Features:

- Browser-based wallet for quick and secure access to DApps.

- Compatible with screen readers for visually impaired users.

- Clean, intuitive design for easy navigation.

Crypto Survival Checklist

Mental Health Resources

Discover strategies to manage trading stress and stay emotionally balanced in the crypto world.

- Set Limits: Only invest what you can afford to lose.

- Avoid FOMO: Do not make impulsive decisions based on market hype.

- Practice Mindfulness: Use apps like Headspace to stay calm during stressful periods.

Stress Management Exercises

- Deep Breathing Exercise: Breathe in for 4 seconds, hold for 7 seconds, and exhale for 8 seconds. Repeat 4 times to calm your mind.

- Progressive Muscle Relaxation: Tense each muscle group for 5 seconds, then release. Start with your feet and work upward.

- Quick Grounding Exercise: Focus on your senses by identifying 5 things you see, 4 things you feel, 3 things you hear, 2 things you smell, and 1 thing you taste.

Mindfulness Tools

Mindfulness can help you maintain focus and reduce impulsive decisions during volatile market conditions. Explore these resources:

- Headspace: Guided meditations to help reduce stress and improve focus.

- Insight Timer: A free app with thousands of meditation sessions.

- Calm: Premium mindfulness tools for stress relief and sleep improvement.

- MyLife Meditation: Personalized mindfulness exercises based on your mood.

Managing Emotional Triggers

Cryptocurrency trading often triggers emotions like fear, greed, and anxiety. Here's how to manage them:

- Fear of Missing Out (FOMO): Set a clear plan for investments and avoid chasing sudden price movements.

- Fear of Loss: Only invest money you can afford to lose and consider using stop-loss orders.

- Greed: Stick to your profit targets and don't overextend your positions.

- Uncertainty: Diversify your portfolio to reduce reliance on a single asset.

Keep a journal to track your emotions and trading decisions. Reflecting on patterns can help you develop better habits.

Support Networks

You do not have to face the challenges of trading alone. Here are some communities and support networks:

- Reddit Crypto Communities: Discuss strategies and share experiences.

- Discord Crypto Servers: Join groups dedicated to crypto education and trading support.

- Meetup Groups: Find local crypto enthusiasts and attend events.

- National Alliance on Mental Illness (NAMI): Free resources and support for mental health challenges.

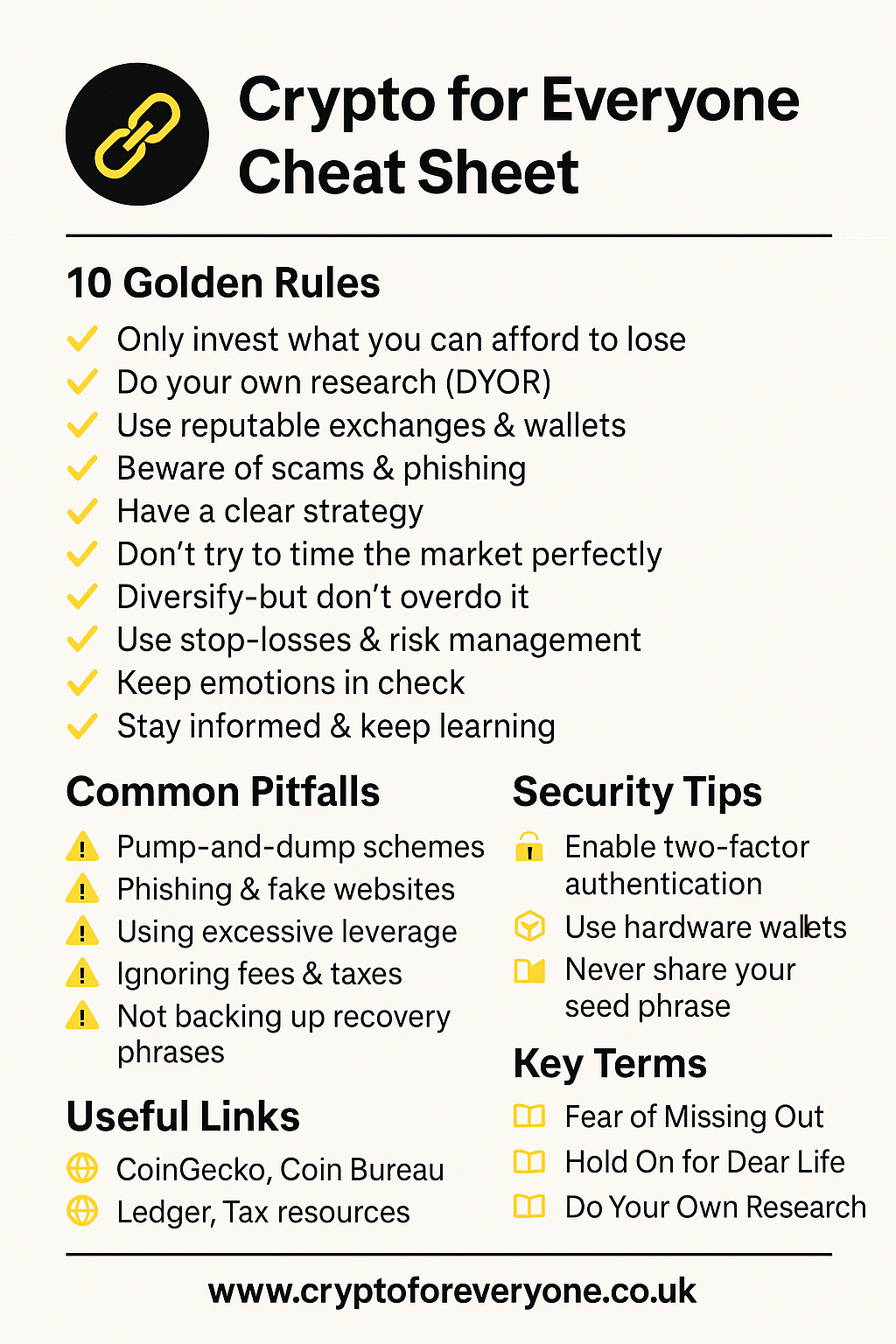

10 Golden Rules To Crypto

||| Download Cheat Sheet |||

Join Our Community

Connect with fellow crypto enthusiasts, share experiences, and learn together in a supportive environment.

Forums

Participate in discussions, ask questions, and share knowledge on our community forums.

Natoshi Bitcoin. Crypto Market Bitcoin/Altcoin TalkCommunity Group Chat - Crypto for Everyone

Join our Telegram channel to engage in real-time conversations with community members.

Join TelegramEducation

Here are some free lessons from trusted crypto learning hubs:.

Coinbase Learn — Beginner-focused, includes simple explainers.

Kracken Learn Center — Easy guides for crypto basics, staking, trading safely.

🧑🏫 DeFi Academy by DeFi Pulse What it is: Community-driven site with free explainers for DeFi concepts. Good for: When people are ready to understand staking, yield farming, etc.

🏆 Bonus — Free University-Level Blockchain Course— University of Nicosia — Free MOOC on Blockchain & Digital Currency,(Very good reputation. You get a certificate if you finish!).